Testing RSS Feeds.. ignore post.

Testing RSS Feeds.. ignore post.

Foreclosures Up Year-Over-Year: Is the Dam Finally About to Burst?

By: Rick Sharga,

Founder & CEO, CJ Patrick Company

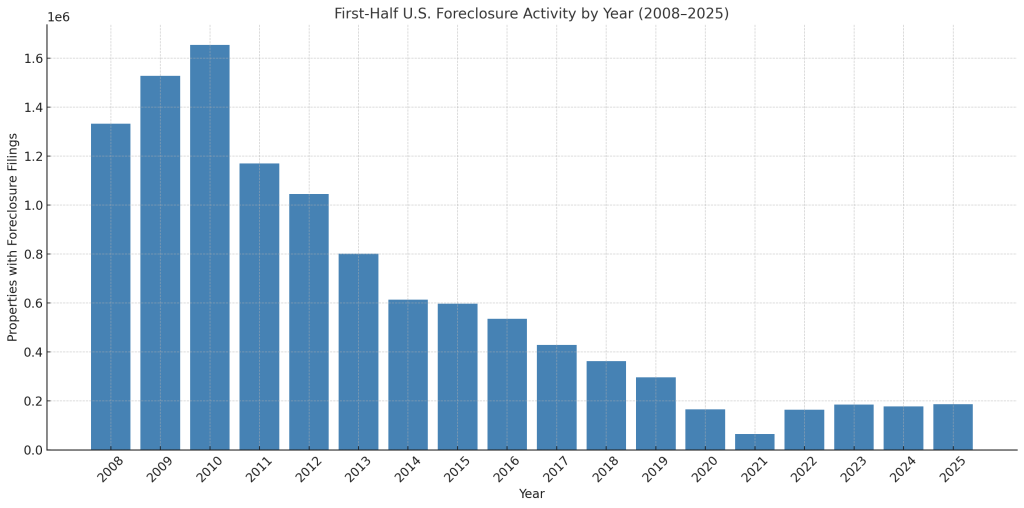

ATTOM released its Mid-year 2025 Foreclosure Report, noting that foreclosure activity – foreclosure starts, notices of sale, and REO actions were up almost 7% compared to the first half of 2024. Is this – finally – an indication that the historically low levels of foreclosure activity we’ve seen since mid-2020 are about to revert to normal?

There were foreclosures started on over 140,000 loans in the first half of this year, a 7% increase from a year ago. REO actions (lender repossessions) were up even more dramatically: the 21,000 properties repossessed was 12% higher than last year’s mid-year total. And foreclosures were being executed much more quickly than a year ago – the average 645 days it took to complete a foreclosure across the country was 21% faster than in the first half of 2024.

June foreclosure numbers also showed some acceleration. The 21,782 foreclosure starts in the month were 17% more than June last year, and REO actions were up a whopping 35% from 2024 totals at just under 3,900. (To see the full report from ATTOM, click here.)

Market Dynamics Point Towards Rising Numbers

For default servicing professionals, this report is encouraging, and might suggest that after declining unexpectedly in 2024, foreclosure actions might be on pace to reach their highest numbers since 2019. Other data suggests that market dynamics are shifting in a way that could result in more foreclosure activity than we’ve seen over the past five years:

- Consumer debt hit a record high of $18.2 trillion in the first quarter of 2025

- Serious delinquency rates on consumer credit – auto loans, credit cards, and student loans – is at or above pre-pandemic levels

- Mortgage delinquency rates have increased for two consecutive quarters

- And, according to Auction.com, foreclosure sales are up 20% year-over-year

FHA Portfolio Likely to Add the Most New Foreclosure Actions

The FHA portfolio of loans is especially worth watching as we move through the second half of the year, particularly on loans issued since 2022, in markets where property values are flat or declining. Roughly 11% of FHA loans are delinquent – 775,000 loans in all – at a time when FHA’s loss mitigation program is about to tighten up. Borrowers who had previously been able to forestall foreclosures by cycling through the FHA’s partial claims program multiple times will no longer be able to do so, meaning that a higher percentage of delinquent FHA loans will roll over from delinquency into foreclosure over the second half of the year.

The FHA portfolio of loans is especially worth watching as we move through the second half of the year, particularly on loans issued since 2022, in markets where property values are flat or declining. Roughly 11% of FHA loans are delinquent – 775,000 loans in all – at a time when FHA’s loss mitigation program is about to tighten up. Borrowers who had previously been able to forestall foreclosures by cycling through the FHA’s partial claims program multiple times will no longer be able to do so, meaning that a higher percentage of delinquent FHA loans will roll over from delinquency into foreclosure over the second half of the year.

And distressed FHA borrowers with recently issued loans may be the most vulnerable. Here’s a nightmare scenario for these borrowers:

- Purchased a home when or after the market peaked in 2022 with a 3.5% down payment loan

- Home is located in a market where home prices have declined, like Texas or Florida

- Property insurance premiums have doubled – or tripled – in the past few years

- Household has suffered a loss of income, and began missing mortgage payments

While this scenario will probably only apply to a small percentage of the FHA book of business, there’s little chance that these borrowers will escape without a foreclosure, or perhaps a short sale.

Not a Tsunami – but a Slowly Rising Tide

Rising delinquencies and foreclosure starts – driven in large part by a deteriorating pool of FHA loans – will likely result in overall foreclosure activity increasing in 2025, but probably not quite getting back to pre-pandemic levels. And it’s important to keep things in context: 2019 was the ninth straight year that foreclosure activity declined, after peaking in 2010; so even a return to that level of activity doesn’t constitute a foreclosure tsunami by any means.

But after five years of artificially suppressed delinquencies, defaults, and foreclosures, it does look like the road ahead is finally leading back to a more normal market environment.

Author

We are Social!

Latest tweets

Popular Tags

Testimonials

"5 star service ! prompt serving, helpful, professional . "

"Mike is awesome. Our firm has hired him on several occasions and we are very happy with his work. His prompt serving, helpful, professional and always in communication. I recommend him highly! "

"360Legal provides speedy and easy to use Process Service that is flexible, and very transparent with nearly instant reporting. It is very helpful for us to be able to track the status of our process service jobs, especially when they are time sensitive. "

Latest News

-

RMAI 2021 Annual Conference RMAI Annual Conference

April 12-15, 2021 -

NATIONAL CREDITORS BAR ASSOCIATION 2020 SPRING CONFERENCE

May 19-21, 2021 -

ALFN ANSWERS 2021

Jul 18-21, 2021 -

Annual Convention and Expo

Oct. 17-21, 2021 -

Florida Association of Professional Process Servers 33rd Quarter Board Meeting/Professional Beach Getaway

Aug. 20-22, 2021